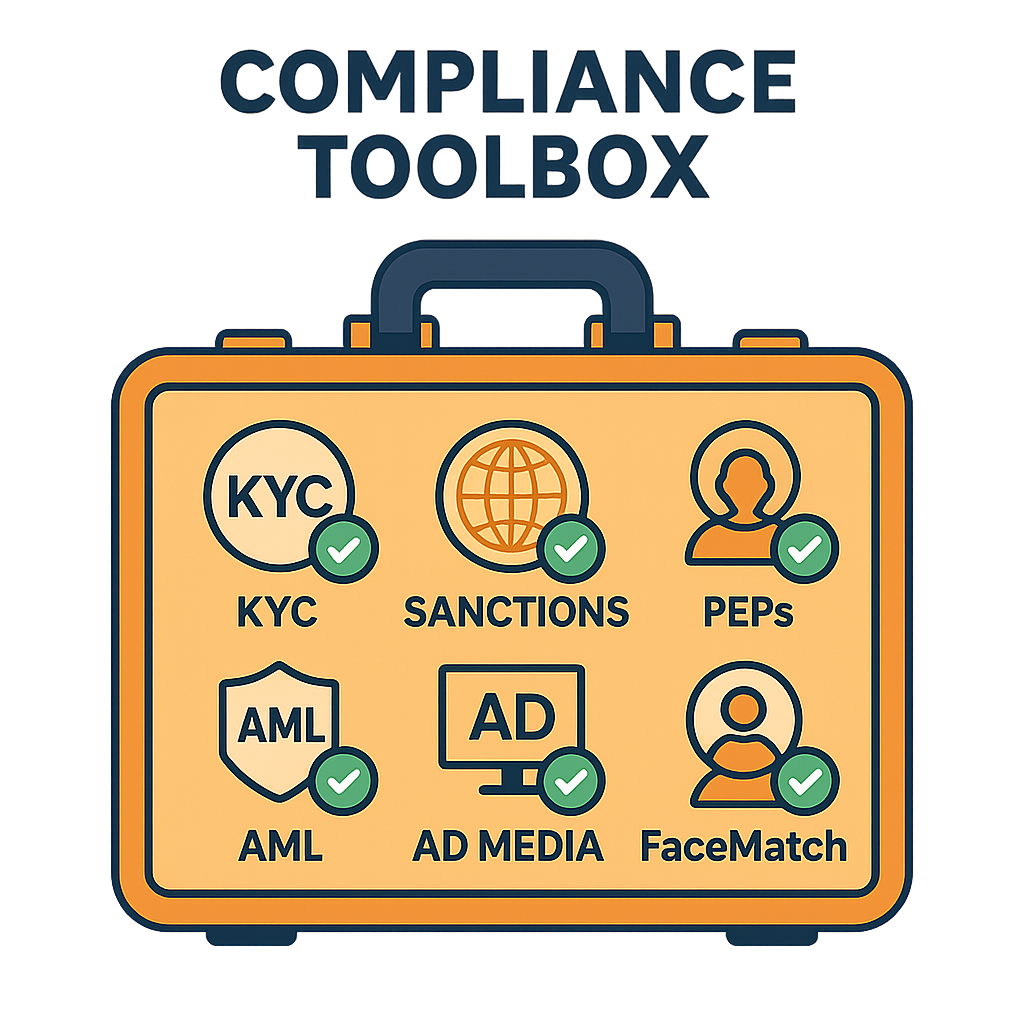

Fully compliant KYC & AML

Pay-as-you-go

No lock-ins. Credits never expire.

Trusted by 500+ businesses since 2017

No lock-ins. Credits never expire.

Trusted by 500+ businesses since 2017

Auto-detect, MRZ, number & expiry validation, cross-check visual & barcode.

Selfie + PAD L1–L3 matched to the ID photo.

PEPs, Sanctions & Adverse Media with webhook alerts.

Exportable audit trails and evidence bundles.

Capture a live selfie, verify liveness, and match it to the ID photo. PAD detection ensures the person really is present.

Toggle liveness, pick document types, and set capture hints — no code required.

We verify the integrity of government-issued IDs with layered signals and cross-checks so fraud has nowhere to hide.

Multiple signals reduce false approvals and stop common forgeries without extra setup.

Enable it and your verified customers continue to be screened automatically. If risk changes, you're notified straight away.

KYC is a snapshot in time. Monitoring keeps that snapshot alive with daily or weekly checks against PEPs, Sanctions and Adverse Media.

If someone tries again with a new ID but the same face, we catch it. That's how you deter repeat fraud attempts without blocking legitimate customers.

Reported faces are embedded and matched in future checks. You get alerts, not auto-declines, keeping you in control.

Complete verification reports for compliance. Every decision captured, every time.

Every KYC attempt creates a PDF report with all decisions and evidence. One-click download and automatic retention for compliance.

Sign up free, buy credits when ready.

Start in minutes, not weeks. Self-service onboarding and easy dashboard controls.

Transparent, credit-based pricing with no lock-ins.

Friendly UK-based help when you need it — without the enterprise overhead.

Automate decisions and monitoring with REST endpoints and clean webhooks. Extra deep-check features are available via API integration.

Clear payloads and examples in the docs. Start with sandbox, go live when ready.