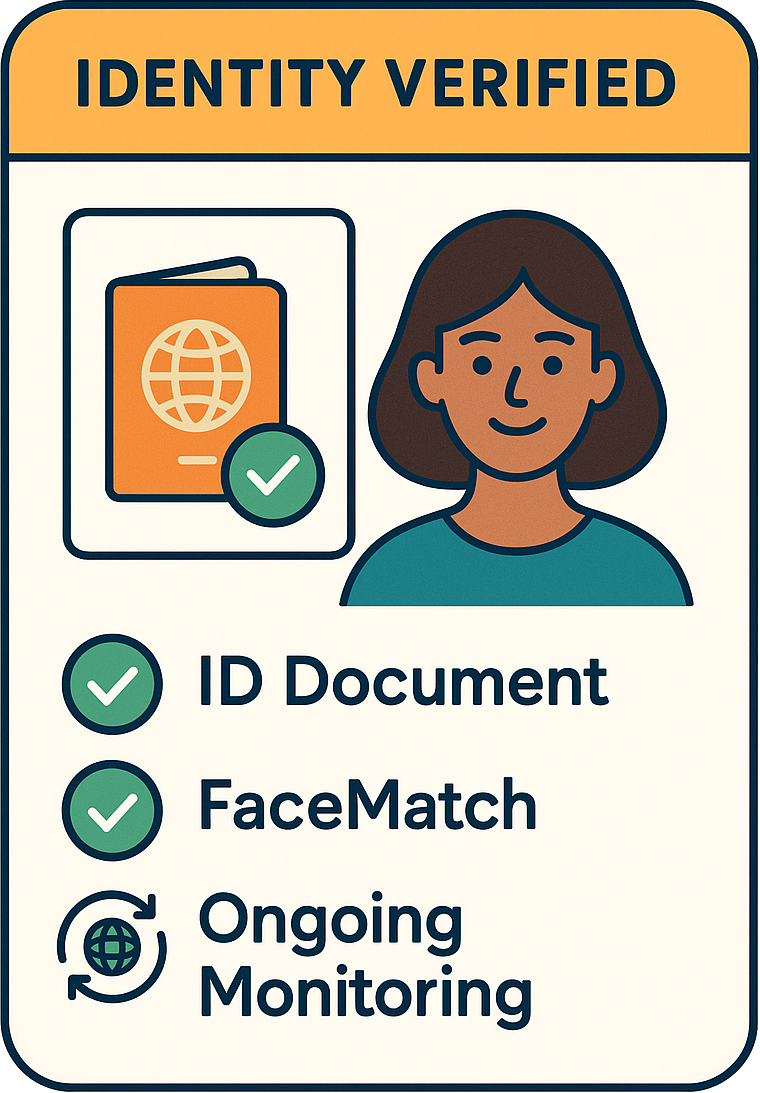

Ongoing Monitoring

Keep checks alive, automatically.

PEPs • Sanctions • Adverse Media

KYC is a snapshot in time. Monitoring makes it continuous. Once a customer is verified, LEM keeps screening them on schedule — and alerts you if their risk changes.